A doksi online olvasásához kérlek jelentkezz be!

A doksi online olvasásához kérlek jelentkezz be!

Nincs még értékelés. Legyél Te az első!

Mit olvastak a többiek, ha ezzel végeztek?

Tartalmi kivonat

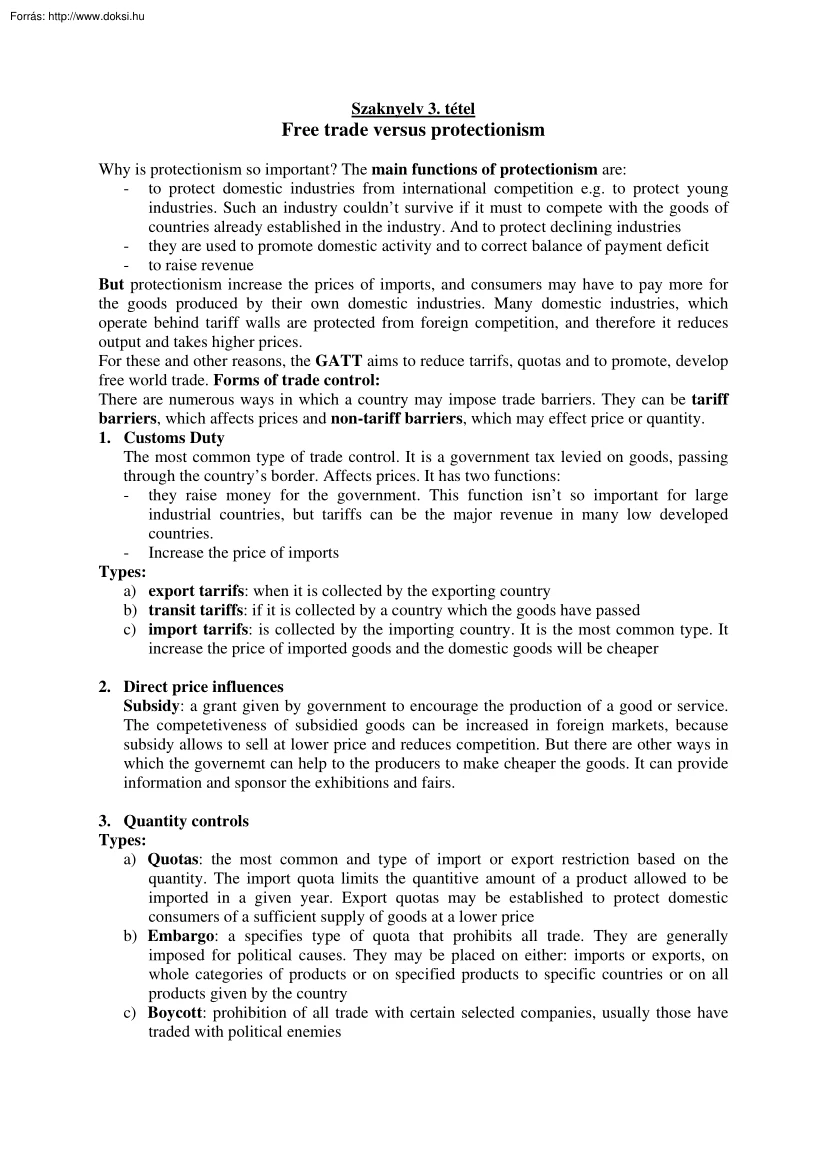

Szaknyelv 3. tétel Free trade versus protectionism Why is protectionism so important? The main functions of protectionism are: - to protect domestic industries from international competition e.g to protect young industries. Such an industry couldn’t survive if it must to compete with the goods of countries already established in the industry. And to protect declining industries - they are used to promote domestic activity and to correct balance of payment deficit - to raise revenue But protectionism increase the prices of imports, and consumers may have to pay more for the goods produced by their own domestic industries. Many domestic industries, which operate behind tariff walls are protected from foreign competition, and therefore it reduces output and takes higher prices. For these and other reasons, the GATT aims to reduce tarrifs, quotas and to promote, develop free world trade. Forms of trade control: There are numerous ways in which a country may impose trade barriers. They

can be tariff barriers, which affects prices and non-tariff barriers, which may effect price or quantity. 1. Customs Duty The most common type of trade control. It is a government tax levied on goods, passing through the country’s border. Affects prices It has two functions: - they raise money for the government. This function isn’t so important for large industrial countries, but tariffs can be the major revenue in many low developed countries. - Increase the price of imports Types: a) export tarrifs: when it is collected by the exporting country b) transit tariffs: if it is collected by a country which the goods have passed c) import tarrifs: is collected by the importing country. It is the most common type It increase the price of imported goods and the domestic goods will be cheaper 2. Direct price influences Subsidy: a grant given by government to encourage the production of a good or service. The competetiveness of subsidied goods can be increased in foreign markets, because

subsidy allows to sell at lower price and reduces competition. But there are other ways in which the governemt can help to the producers to make cheaper the goods. It can provide information and sponsor the exhibitions and fairs. 3. Quantity controls Types: a) Quotas: the most common and type of import or export restriction based on the quantity. The import quota limits the quantitive amount of a product allowed to be imported in a given year. Export quotas may be established to protect domestic consumers of a sufficient supply of goods at a lower price b) Embargo: a specifies type of quota that prohibits all trade. They are generally imposed for political causes. They may be placed on either: imports or exports, on whole categories of products or on specified products to specific countries or on all products given by the country c) Boycott: prohibition of all trade with certain selected companies, usually those have traded with political enemies Szaknyelv 5. tétel Retail trade

Retail trade is a part of commerce, where goods are sold to the final consumer. The retailer performs a number of important functions: - He buys in large quantities and cut up into small quantities. - Stocks: hold stocks which the consumer can purchase locally in small, convenient quantity. - Choice: the consumer is able to choose from the variety of products of different producers offered by retailer. - Information and advice: the retailer’s expert knowledge enables them to advise and inform customers on quality and suitability of products. - Feedback: he provides a feedback of consumer responses to wholesalers and producers. Types of retailer: 1.) Door to door: traders involved in this form of selling generally deal in sales of minor items of goods and services. - Pedlars: carry goods from door to door on foot. - Hawkers: use some method of transport - Mobile shops: a vehicle adapted to serve as a travelling shop. 2.) Market traders: they usually sell their goods in small houses,

in stalls in open areas, sometimes in street. They are often able to keep prices low, because they avoid overheads eg heating, high rent, shop fitting. 3.) Independent shops (sole traders): is owned by a sole trader or small partnership, and is typically sited away from town centres. It often specialises in offering a single commodity or service. (barker, butcher) Its advantages are: - saves customers for need to travel into town - sometimes allows customers credit Disadvantages: - Can’t buy in very large quantities - prices often higher than in larger shops - difficulties in running shop if the owner is sick 4.) Multiples: (Chain sores): are chains of shops trading under a single name of common ownership. They are generally controlled from central headquarters and often be sited in town centres and shopping centres. It enjoys many advantages over smaller retailers: - their large size enables them to by-pass wholesalers and buys in large quantities from the producer. - they have the

resources to rent or buy stores in the centre of the city, with large car parking space. - they can afford to attract customers with ‘loss leaders’ (goods sold at below cost price) 5.) Self-service stores and supermarkets: It is a supermarket when it has more than 2000 square feet of shopping area and 3 or more check-out points. Advantages: - These shops deal particularly in pre-packed, price-labelled products. - Loss-leaders are frequently used to attract customers - Customers serve themselves - Shopping trolleys helps the customers’ - impulse buying (unplanned purchase) 1 Disadvantages: - pilferage (stealing) levels are high - customers receive little personal contact - shopping trolleys are stolen Loss leaders: Usually the supermarkets pursue this policy, which means: cutting the price of some popular article very much below the market price in order to attract customers to the shop. 6.) Department stores – „shop of shops” It is divided into commodity departments.

Each department is operated like a single shop and has its own profit. Advantages: - customers can do the shopping in comfort - wide variety of goods available under on roof - shop assistants give personal service - sited in towns Disadvantages: - large central sites are expensive - can’t compete with prices of multiples - comfort surrounding costs a lot of money 7.) Hypermarkets: They are a very large form of supermarket with a shopping area in excess of 50000 square feet. They offer a very wide range of goods in many specialist departments similar to the department store. - Parts of the hypermarket complex may be rented out to other traders. - they are frequently sited on the outskirts of towns, where sites are cheaper. - good parking is provided and some late night trading 8.) Mail-order: products are sold through the mail order method: - advertising in the press, TV, radio, inviting potential customers to buy by post. - direct selling to customers choosing articles from a

catalogue at home Advantages - interest free credit often given - buying in comfort of home - goods chosen at leisure Disadvantage: - prices often more expensive than shops - difficult to assess quality from a catalogue 9.) Vending machines: - retail outlets open 24 hours a day and provide a wide variety of products (hot and cold snacks, confectionery, drinks, petrol). - they are sited in busy public spaces and they sometimes suffer as a result of vandalism. 2 Szaknyelv 6. tétel Wholesale trade Wholesalers are businessmen who handle goods in the intermediate position between the producer and the retailer, buying in large quantities and selling in smaller. Traditionally they have always dealt in large quantities. Their shops are usually a large warehouse divided into sections. Retailers may visit the wholesaler to choose goods, or orders may be also telephones in or visit the wholesaler’s representative. Functions of the wholesalers: 1. Acting as an intermediary: He is

positioned between the producer and the retailer But there are exceptions where the producer will sell direct to the retailer or to the consumer. 2. Breaking of bulk: buying in large quantities from the producer and selling in small lots, usually to the retailer. 3. Taking on risks: if the wholesaler buys goods he bears the risk for it There is always the risk that - the price of a finished product may fall or - the goods won’t be needed because there is no demand. - deterioration: (megromlás) - someone stole it 4. Warehousing: by storing goods the wholesaler saves space for both the producer and the retailer. 5. Offering credit: he may supply goods and allow the retailer to pay at some later date (trade credit). Services provided by the wholesaler For the producer: - reduces transport costs: transport goods from the point of production - finishes goods by grading, packing and branding - make mass production possible by ordering in large quantities and therefore reducing production

cost For the retailer: - offers choice of products from many producers - supplies small quantities to suit retailers needs - quick access to goods and open until late in the evening - advises latest trends and ‘best buys’ - pre-pack goods for the retailers’ shelves (graded, labelled, priced, weighted) Types of wholesaler – three basic forms: 1.) General wholesalers: operate very large warehouses access from many local towns 2.) Cash and carry wholesalers: don’t allow credit and don’t deliver goods Retailers come to warehouses, select goods, pay for them and provide their own transport. 3.) Co-operative Wholesale Society: it supplies its own retail outlets, often obtaining goods from its own factories, farms and plantation. Elimination of wholesaler: Sometimes the producers will by-pass the wholesaler and sell directly to the retailer (in these cases) - if the retailer is part of a large multiple chain, it can buy in large quantities and deal direct with the producer -

where after-sales service is particularly important: durable consumer goods Szaknyelv 7. tétel Agency Agents When you export your goods, you may need the service of some kind of agencies to ensure that the goods reach the final user. Agencies usually work in the country of the buyer Goods should be controlled by agents when: - a knowledge of a distant market is needed - after-sales servicing is needed - you want to introduce goods to a new market Types of agents: 1. Commission agent: He gets orders for goods in name of the exporter He gets a commission for the business what he received. Rates of commission is various, if he has to supply a great deal of information and provide an after-sales services, he gets more money. 2. Del credere agent: The agent takes the credit risk in name of his customer, and he guarantees payment. If so, he gets a higher rate of commission 3. Sole agent: He is appointed for a territory and he gets a commission from all of the business, maked in this

area. The main tasks of commission agents: - control orders - checking the documentation - he is the seller’s representative in the market - he doesn’t carry stock Distributors He is also an agent, but his task is to stock the product and sell it for local buyers. Usually he buys the product from the seller and re-sells it at a higher price, that he makes a profit. Types of distributors: 1. Sole distributor: He ha the exclusive importing rights for a territory He provides after-sales services and sends back information. 2. Distributors who have the goods on consignment: He doesn’t buy the goods, he only receives it from the exporter. The distributor is only responsible for selling them and then accounting to the exporter. Sources of finding an agent: - advertising in trade journals - contacting government departments of trade - consulting Chambers of Commerce, Consulates and banks Parts of the Agency Agreement 1. The names and addresses of both parties 2. The aim of the agreement

3. A description of the goods 4. The territory 5. The duties of the agent 6. Any restrictions 7. The prices and terms 8. Payments for additional work 9. The starting date of the agreement Szaknyelv 8. tétel Transport (air, road, rail and sea) Development of Transport In primitive times animals were used for transportation. Vehicles were pulled by dogs, horses, elephants and camels. They are still an important means of transport in various parts of the world. Water transport started early in cities, London, Paris, Rome which are situated on a river or near to the sea. Road making began at a period when water transport was already highly organized. The first roads in Hungary were also built by the Romans At the end of the 18th century the steam engine was invented. The first public railway in the world, the Stockton and Darlington line opened in England in 1825. At the same time steamships began to operate. In the 20th century steam engines were replaced by electric engines on the

railways and by diesel engines. Nowadays some modern ships use atomic energy. An important development in road transport was the invention of the internal combustion engine. Development of the car and truck industry is very important But for transportation of heavy freight (coal, iron, ore), especially over long distances, railways must still be relied upon. The beginning of the 20th century saw the invention of the airplane At the beginning airlines were used for passenger transport. The first type of air freight was mail, which took up relative little space. Now special aircraft have been designed and are flown on a “cargo only” basis. Rail transport: Today there is a hardly a country in the world, where the railways do not lose money. Rail traffic is fast when actually moving. If goods are to go a long way, rail transport is probably the best. The economic limit is 200 miles Below that limit, road transport is more economic It is economical in the use of labour, because one

driver and two guards can take 60 tons of carriages. Compared with road transport, where lories can take only 32 tons, we can see the advantages of the rail transport. Railway transports has a big problem, and it is the terminal problem. It does not transport for door to door Goods must therefore be loaded and unloaded at terminals to complete their journey by road vehicles. The document used in rail transport is the Consignment Note, which is a receipt for the goods and a contract of carriage. It is made out in several copies. The first copy accompanies the goods It is the duplicate of the Consignment Note. Road Transport: The chief advantages of road transport are: - Terminal handling is eliminated by door-to-door delivery. - Delivery is made direct to the consignee’s premises - Road vehicles are extremely flexible, and computerized route charts can now be prepared which give the most direct or most economic route to be followed. - Specialized vehicles of great variety have been

produced The document used for international road transport is the Consignment Note. Air transport: In modern time an increasing amount of goods is travelling by air. It’s very expensive, but a saving can be made on packing cost, and the insurance premium may be lower. This type of transportation is used when merchandise is urgently required (medicines, fruit, flowers, early vegetables.) or the goods represent a high value (jewellery, furs, watches) Advantages: 1 - the speed of transport - the exporter and the importer are closer to a city with an airport than a seaport Disadvantages: - Its quite expensive - It is unsuitable, of course, for large and bulky goods over, say 30 tonnes in weight. The document used in Air Transport is the Air Waybill. This is a receipt for the goods, and a contract of carriage. Sea transport: Shipping is divided into two main classes: 1. chartered vessels 2. conferences and liner services Chartered vessels are designed mainly to carry such cargoes as

coal, ores, grain, timber etc. The advantage of this shipping is that the ship steamer can be at the port when the cargo is required to be moved. There is a minimum of waste movement Cargo liner companies provide regular traffic between ports in different parts of the world. They are called “conferences” because they hold meetings to agree on routes, timetables, rates. They sail according to a fixed schedule, have fixed routing and the freight rates are quoted according to fixed tariffs. Sailing lists shows the date of sailing, the name of the ship, the closing date, i.e the latest date on which the vessel receives cargo, and the date of arrival at the port of destination. The trade in shipping space is mostly in the hands of shipbrokers. The most important centres of such a trade are exchanges like the Baltic Mercantile and Shipping Exchange in London; moreover there are many other international or local markets at important ports. Pipelines: Pipelines, as a means of transporting

gas, oil or water have assumed a new importance in recent years. The capital costs of installing a pipeline can be considerable, but once laid, the running costs can be low in terms of unit transport cost per kilometre. Forwarding: It is highly important for a foreign trading company to reduce transport costs. The task of minimizing costs of carriage requires special knowledge and training. The agent serving the purpose is called a forwarder. The forwarding agent is bound to enter in his own name and on the principal’s account into contracts of carriage necessary to the transportation of the consignment, while the principal is bound to pay due remuneration therefore. 2 Szaknyelv 10. tétel Incoterms Standardization of Commercial Terms Sending goods from one country to another can be a risky business. If the goods are lost or damaged on the way, disputes may arise between buyer and seller. To avoid such disputes, it is usual to agree, who bears the costs and risks of the

delivery of the goods and up to what point. In the course of the long history of international trade, special commercial terms have been developed. These terms make it possible for the buyer and seller agree on the terms of the sale of the goods without having to define in detail their respective responsibilities in each particular case. The best-known such terms are Incoterms They were first formulated by the International Chamber of Commerce. Incoterms The latest edition of Incoterms contains more than a dozen commercial terms. EXW (Ex Works) The seller places the goods at the disposal of the buyer at the factory. The buyer bears all charges and risks from the time the goods have been placed at his disposal. He pays the price, customs duties taxes, and insurance He pays for the documents that he may need. FOB (Free on board) The seller places the goods on board a ship named in the sales contract. The buyer bears the risk of loss of or damage to the goods from the time the goods have

passed the ship’s rail. The buyer will bear all the expenses and charges of the freight, insurance, etc. CIF (Cost, insurance and freight) The seller delivers the goods to the named port of destination and pays the freight charges. Buyer bears the risk of loss of or damage to the goods from the time the goods have passed the ship’s rail. The seller must also provide all the necessary documents. CFR (Carriage and freight) is essentially the same as CIF, except that it doesn’t include insurance. DCT (carriage paid to the named point of destination) DCT means that the seller pays the freight for the carriage of the goods to the point of destination. The buyer bears the risk from the time the goods have been placed to the first carrier. DCT is used in all kinds of transport, including ferries, containers and trucks. CIP (carriage and insurance paid to) The same as DCT, expect that the seller must pay insurance against the risk of loss of or damage. DES (Ex ship) The seller must make

the goods available to the buyer on board the ship at the destination named in the contract. The seller bears the full cost and risk of bringing the goods there. DAF (Delivered at frontier) The goods are carried by rail or by road. The seller places the goods at the buyer’s disposal at the frontier. The buyer bears all the costs and risks from the time the goods have been placed at his disposal. DDP (Delivered duty paid) Szaknyelv 11. tétel Shipping documents A transport document is a document that indicates the loading on board or dispatching the goods. Its functions are to provide evidence of a contract of carriage, evidence of receipts of the goods, and in some cases they are also documents of title, giving the holder of the documents title of the goods. They are necessary to prove the executing of an order 1. Bill of lading A transport document for goods shipped by sea, in which the ship-owner acknowledges the receipt of the goods and deliver them to their destination under

the terms agreed upon. It has 3 functions: - evidence of a contract of carriage between the shipping company and the buyer to transport the goods by sea - receipt for the goods, and provides some details about the condition of goods received - document of title to the goods, the holder of the B/L has the right to get the goods. Title to the goods can be transferred by the sender by endorsement Types: a) Shipped on Board B/L: acknowledges that the goods have been actually received on board b) Received for Shipment B/L: acknowledges that the goods are in the care of the ship-owner for carriage on a ship, but doesn’t say that the goods on board c) Through B/L, Combined transport B/L: the goods are carried by 2 or more modes of transport 2. Sea waybill or liner waybill A waybill is a list of goods carried. A sea waybill is a transport document which gives details of goods and it acts as contract between the shipping company and the exporter receipt by the shipping company and the

exporter The shipping company will deliver the goods to the consignee named in the bill, without the consignee having to give the shipping company an original copy of the waybill. it is used: if the exporter is sending goods to an overseas subsidiary if the exporter sells goods on open account terms Szaknyelv 12. tétel Means of payment (cheque, bill of exchange) Cheques Cheques are substitute for money and they are easy and safe to use. It is the owner’s direction to a bank to pay a sum of money to a named person or company. Parties to a cheque: - Drawer: he or she draws the cheque - Payee: he or she is the person, to whom the cheque is payable - Drawee: it is the bank, which pays The cheque is only valid if it is dated and signatured by the drawer in the bottom right-hand corner. Different types of cheques: 1. Open cheques (not crossed): The payee could take it to a bank and obtain cash, but anyone else might also be able to cash it. (It concludes the payee’s name)

2. Crossed cheques: they have two parallel lines drawn vertically across them, and are safer than open cheques, because they can only be paid through somebody’s bank account. They can’t be exchanged for cash 3. General crossing: „and company” or „&Co” Is written between the lines The cheque can be paid only to the bank. 4. Special crossing: If the name of the bank is written between the lines the cheque can be paid only to the named bank. A cheque is a negotiable instrument of payment. It can be transferred from person to person before it is actually paid by the bank. The cheque can be transferred by endorsement 1. Blank endorsement on a cheque is an endorsement, which does not state that to whom is that cheque payable it will therefore be paid to the person who presents it. The endorser simply signs his name on the back of the cheque. 2. Special endorsement on a cheque is that only one name of a person to whom or to whose order the cheque is payable. „Pay Beringer

Robert or order” 3. Restrictive endorsement on a cheque is one name, which forbids further negotiation of the cheque. „Pay Beringer Robert only” Bills of exchange A bill of exchange is an unconditional order in writing, addressed by one person (drawer) to another (drawee) signed by the person giving, requiring the person to whom it is addressed to pay on demand or at a future fixed time a sum of money to a specified person. Bills of exchange can be transferred by endorsement. The person who transfers them is the endorser, the other one to whom it is transferred is the endorsee. Any endorser is fully liable for the bill and must pay it if the acceptor fails to pay. If an endorser does not want to be hold responsible for the bill, he writes a signature: „without recourse to me”. Bill of exchange must be presented for payment during business hours on the day they are due. If the date of maturity falls on Sunday or any other holiday, the bill is due on the last working day. If it

falls on a bank holiday, the bill is due on the next working day. If the drawee refuses the bill or to pay on maturity, the bill is said to be dishonoured and must be protested. The bill payable at a future time might sold to a bank or a discounting house, which pays the sum of the bills less interest and discounting charges. Szaknyelv 13. tétel Methods of payment (letter of credit, documentary collection) D O C U M E N T A R Y C O L L E C T I O N (D/P O R D/A) It is an operation in which a bank collects payment on behalf of the seller by delivering documents to the buyer. It is only used if there is a relationship of trust between the buyer and the seller. A D/P is a suitable method of payment if The buyer’s ability and readiness to pay are all right The political and economic conditions in the importing country are stable. The importing country places no restrictions on imports 1. 2. 3. 4. exporter, seller remitting bank presenting bank (collecting bank) importer,

buyer The four parties to the operation: How does a D/P work? 1. The exporter stipulates the terms of payment with the buyer in the contract of sale 2. After the signing of the contract of sale, the seller dispatches the goods direct to the address of the buyer. He sends all the necessary documents to his own bank (the remitting bank) together with the collection order. The remitting bank then remits the documents, together with the necessary instruction, to the collecting bank. 3. The presenting bank informs the buyer of the arrival of the documents The buyer makes payment, or accepts the bill of exchange, and in return receives the documents. The presenting bank then transfers the collected amount to the remitting bank, which credits it to the principal’s account. THE DOCUMENTARY LETTER OF CREDIT It is a reliable and safe method of payment, and it protects the seller as well as the buyer. It is an undertaking given by a bank at the request of a buyer to pay a particular

amount in an agreed currency to a seller How does a L/C work? 1. The buyer (importer) asks his bank to issue or open a L/C in favour of the seller There is usually a special application form, which the buyer fills in and sends to his bank. 2. The buyer’s bank will then select a bank in the exporter’s country and notify them that the credit has been opened. 3. The seller’s bank will notify the exporter that a credit has been opened 4. The seller (exporter) ships the goods before the credit expires and sends the shipping documents to his bank that checks the documents against the conditions and pays him. 5. The seller’s bank will then send the documents and debit the buyer’s bank with the cost and charges. 6. The buyer’s bank then checks the documents, pays the seller’s bank and sends the documents to the buyer so that he can claim the goods. Szaknyelv 14. tétel Banks Historical background The Hungarian banking system is linked historically to the Austrian banking

system. Austrian commercial banks together with the central bank traditionally carried out their activities in Hungary. After 1945a process began to nationalise the banking system. The law stated the ownership of the NBH and the main commercial banks. The primary functions of the NBH were developed in 1948, and a one-tier banking system has been established. In this model the central bank provides commercial bank functions, grants credits, and accepts deposits. The two-tier banking system On January 1, 1987 changes were introduced in Hungary’s banking system. The central and commercial banking functions were separated. The new two-tier banking system is, where the central bank is the bank of the banks, and the commercial banks are in direct contact with companies and public. The new system allows the NBH to focus on macroeconomic policy issues, leaving the microeconomic aspects to the commercial banks. The main functions of the central bank are the followings: - it issues bank notes

and coins - it makes proposals for money and credit policy - determines the rules of money circulation - it collects reserves of gold and foreign exchange and manages them - it determines and publishes the official exchange rate of foreign currencies - it coordinates the relation of Hungary with the international financial institutions The NBH has complete independence in the formulation of its policy, but it must determine the exchange rate policy with the government. When the two-tier banking system was started in January 1987 the commercial banking functions (keeping accounts, active and passive banking operations etc.) were taken over by three new big commercial banks - Hungarian Credit Bank Ltd. (MHB) - Commercial and Credit Bank Ltd. (KHB) - Budapest Bank Ltd - Hungarian Foreign Trade Bank Ltd. Banking services to the population (to the public) were provided by the National Savings Bank (OTP), and Postabank. At the start of the two tier banking system, 15 non-monetary financial

institutions functioned in Hungary Szaknyelv 15. tétel Complaints and ajustments Complaints Non-fulfilment of the contract may be caused by the seller ot the buyer, or by so called „Act of God”. When the buyer or the seller is at fault, a letter of complaint is sent to him If the seller is at fault, the most usual cases are: 1. Defect in quality - bad quality - differencies from the goods, what we have ordered In these cases the buyer may: - refuses to accept the goods - accept the with an extra discount 2. Defect in quantity - oversuply: the seller has delivered more goods than we have ordered - shortshipment: not enough goods have been delivered. In this case the buyer may: - refuse to accept them - accept the as partial delivery - pay for what have been delivered and cancel the rest of the order. 3. Delay It happens when the seller fails to deliver in time. In this case the buyer can extend delivery time. If even the seller doesn’t deliver, the buyer may: - extend the

delivery time once more - buy the goods at the seller’s cost - cancel the order 4. Unsuitable or faulty packing It can cause damage to the goods, and the insurance companies will not accept responsibility about it. In this cases: - the buyer may accept damaged goods if the supplier offers a discount - if the goods are badly dsamaged, the buyer can ask for replacement 5. damages This is usually a matter for the insurance agent 6. Other defects Sometimes documents are not in order, there is a mistake in the invoice. The buyer is at fault, when: - he refuses to accpet the goods without sufficient grounds - he may cause difficulties by omitting to give transport intructions in time - he refuses to pay, thougy ha has already accpeted the goods. In such case it is necessary to send a remainder A letter of complaint should be written in a firm but quiet, and objective tone. Adjustments Before a complaint is admitted, it is necessary to decide whether it is justified. If the costumer’s

complaint is well founded, the claim must be granted promptly, and the seller must to eliminate similar errors in the future. When the customer’s complaint is not justified, the claim is refused, but the seller must carefully explain why he refuses it. It may also happen, that a third party, e.g the carrier is at fault In such cases the seller does his best to make good the fault and to help his customer. A complaint should be answered promptly, if the explanation cannot be sent immediatly he must inform the customer of the result as soosn as possible. Szaknyelv 16. tétel Advertising, sales promotion, trade fairs and exhibition Marketing an Advertising The most important function of marketing is to buy at as low a price as possible and sell at a price high enough to ensure a good profit. In order to achieve that, research is carried out to provide information on the size of the market and the price for which product or service can be sold or bought. Marketing is concerned with

packaging, promoting and distributing the product and also deals with after-sales service. The aim of advertising is to inform the public of the advantages of a product or service (what can be obtained, and where, for how much, etc.) Advertising dates back to ancient times In the Middle Ages street vendors cried the names of the goods they wanted to sell. In the 12th century in France the criers went through the streets giving samples of their drink. Printed advertising came later. Outdoor advertising became popular in England Posters appeared on every wall. Today, the most important advertising media are: newspapers, magazines, radio and television commercials, outdoor advertising and direct mail advertising. It is important for a company to maintain good public relations. By public relations we mean the relations between a company and the general public. These relations must be kept friendly in various ways. Public relations are big business today One important aspect of

communication is advertising. It is the means by which we make known what we have to sell or buy. Without advertising a mass-production system could not function. There are two kinds of advertising, informative and persuasive advertising The latter does not just inform, it uses subtle techniques to persuade and delude the public into buying. Selling goods can rarely be done by the product itself or by price alone Continuous publicity is needed to support the sales efforts and to make known the full range of products. A successful sales campaign depends upon four main fundamentals They are: a good product at a competitive price a sound market policy reliable representatives close personal attention to the market Whether it is consumer or capital goods that are subject of the campaign the main ways in which it can be executed are: paid advertising editorial publicity literature describing the products display materials trade fairs and exhibitions A distinction is made between trade fairs

and exhibitions. Trade fairs are markets, and usually feature the products of one or more industries. They may be visited only by business people. Sales are made on the basis of samples No goods are sold directly at stands. Exhibitions, on the other hand, are meant also for the general public 1 Szaknyelv 17. tétel Types of business companies There are two main enterprises: Private and Public Enterprise Private Enterprise: Business that are owned by private individuals, engaged in the production of goods or services. There are 4 main types of private enterprise: - Sole traders - Partnership - Private limited companies (Ltd) - Public limited companies (Plc) Sole traders This type of company is owned by one person, who provides all of the capital needed to form, or expand the business. This is the simplest and most common type of enterprise Advantages: needs relatively small amount of money, no consulting with partners, no sharing of profits Disadvantages: the business has

unlimited liability, difficulty in continuing business in case of absence, difficult to borrow money. Partnership Two to twenty memebers are in the business and work together for profit. At least one partner must accept unlimited liability. A sleeping partner is one who invests in the business but takes no active part in running it. Advantages: easily formed, greater continuity than sole trader, expenses and management are shared Disadvantages: generally unlimited liability, possible conflicts between partners. Private limited company (Ltd) It is allowed from two to an unlimited number of members (shareholders). The capital of the company is divided into shares, but the shares are not sold on the Stock Exchange and they cannot be advertised for sale publicity. Advantages: more people can provide it with capital, ha greater continuity, has limited liability. Disadvantages: shares cannot be offered for public sale. Public limited company (Plc) It is allowed from two to an unlimited

number of shareholders, and it can advertise shares for public sale. Its shares are listed on the Stock Exchange When an investor buys shares in a company, he becomes a part owner and gets the right to say in the way that company is operated. Advantages: limited liability, maximum continuity, ability to raise large sums of capital, easier to borrow money. Disadvantages: too many rules Special business relationships Franchising: In franchising a company allows someone to buy the right to use their products or techniques under their trade names. It offers a ready-made business opportunity for those who gave the capital and wants to work hard. It also provides a strong marketing background Holding companies: Businesses from a temporary combination to achieve a certain aim, e.g in order to bring together several processes, into one production unit. Each member company retains its legal entity

can be tariff barriers, which affects prices and non-tariff barriers, which may effect price or quantity. 1. Customs Duty The most common type of trade control. It is a government tax levied on goods, passing through the country’s border. Affects prices It has two functions: - they raise money for the government. This function isn’t so important for large industrial countries, but tariffs can be the major revenue in many low developed countries. - Increase the price of imports Types: a) export tarrifs: when it is collected by the exporting country b) transit tariffs: if it is collected by a country which the goods have passed c) import tarrifs: is collected by the importing country. It is the most common type It increase the price of imported goods and the domestic goods will be cheaper 2. Direct price influences Subsidy: a grant given by government to encourage the production of a good or service. The competetiveness of subsidied goods can be increased in foreign markets, because

subsidy allows to sell at lower price and reduces competition. But there are other ways in which the governemt can help to the producers to make cheaper the goods. It can provide information and sponsor the exhibitions and fairs. 3. Quantity controls Types: a) Quotas: the most common and type of import or export restriction based on the quantity. The import quota limits the quantitive amount of a product allowed to be imported in a given year. Export quotas may be established to protect domestic consumers of a sufficient supply of goods at a lower price b) Embargo: a specifies type of quota that prohibits all trade. They are generally imposed for political causes. They may be placed on either: imports or exports, on whole categories of products or on specified products to specific countries or on all products given by the country c) Boycott: prohibition of all trade with certain selected companies, usually those have traded with political enemies Szaknyelv 5. tétel Retail trade

Retail trade is a part of commerce, where goods are sold to the final consumer. The retailer performs a number of important functions: - He buys in large quantities and cut up into small quantities. - Stocks: hold stocks which the consumer can purchase locally in small, convenient quantity. - Choice: the consumer is able to choose from the variety of products of different producers offered by retailer. - Information and advice: the retailer’s expert knowledge enables them to advise and inform customers on quality and suitability of products. - Feedback: he provides a feedback of consumer responses to wholesalers and producers. Types of retailer: 1.) Door to door: traders involved in this form of selling generally deal in sales of minor items of goods and services. - Pedlars: carry goods from door to door on foot. - Hawkers: use some method of transport - Mobile shops: a vehicle adapted to serve as a travelling shop. 2.) Market traders: they usually sell their goods in small houses,

in stalls in open areas, sometimes in street. They are often able to keep prices low, because they avoid overheads eg heating, high rent, shop fitting. 3.) Independent shops (sole traders): is owned by a sole trader or small partnership, and is typically sited away from town centres. It often specialises in offering a single commodity or service. (barker, butcher) Its advantages are: - saves customers for need to travel into town - sometimes allows customers credit Disadvantages: - Can’t buy in very large quantities - prices often higher than in larger shops - difficulties in running shop if the owner is sick 4.) Multiples: (Chain sores): are chains of shops trading under a single name of common ownership. They are generally controlled from central headquarters and often be sited in town centres and shopping centres. It enjoys many advantages over smaller retailers: - their large size enables them to by-pass wholesalers and buys in large quantities from the producer. - they have the

resources to rent or buy stores in the centre of the city, with large car parking space. - they can afford to attract customers with ‘loss leaders’ (goods sold at below cost price) 5.) Self-service stores and supermarkets: It is a supermarket when it has more than 2000 square feet of shopping area and 3 or more check-out points. Advantages: - These shops deal particularly in pre-packed, price-labelled products. - Loss-leaders are frequently used to attract customers - Customers serve themselves - Shopping trolleys helps the customers’ - impulse buying (unplanned purchase) 1 Disadvantages: - pilferage (stealing) levels are high - customers receive little personal contact - shopping trolleys are stolen Loss leaders: Usually the supermarkets pursue this policy, which means: cutting the price of some popular article very much below the market price in order to attract customers to the shop. 6.) Department stores – „shop of shops” It is divided into commodity departments.

Each department is operated like a single shop and has its own profit. Advantages: - customers can do the shopping in comfort - wide variety of goods available under on roof - shop assistants give personal service - sited in towns Disadvantages: - large central sites are expensive - can’t compete with prices of multiples - comfort surrounding costs a lot of money 7.) Hypermarkets: They are a very large form of supermarket with a shopping area in excess of 50000 square feet. They offer a very wide range of goods in many specialist departments similar to the department store. - Parts of the hypermarket complex may be rented out to other traders. - they are frequently sited on the outskirts of towns, where sites are cheaper. - good parking is provided and some late night trading 8.) Mail-order: products are sold through the mail order method: - advertising in the press, TV, radio, inviting potential customers to buy by post. - direct selling to customers choosing articles from a

catalogue at home Advantages - interest free credit often given - buying in comfort of home - goods chosen at leisure Disadvantage: - prices often more expensive than shops - difficult to assess quality from a catalogue 9.) Vending machines: - retail outlets open 24 hours a day and provide a wide variety of products (hot and cold snacks, confectionery, drinks, petrol). - they are sited in busy public spaces and they sometimes suffer as a result of vandalism. 2 Szaknyelv 6. tétel Wholesale trade Wholesalers are businessmen who handle goods in the intermediate position between the producer and the retailer, buying in large quantities and selling in smaller. Traditionally they have always dealt in large quantities. Their shops are usually a large warehouse divided into sections. Retailers may visit the wholesaler to choose goods, or orders may be also telephones in or visit the wholesaler’s representative. Functions of the wholesalers: 1. Acting as an intermediary: He is

positioned between the producer and the retailer But there are exceptions where the producer will sell direct to the retailer or to the consumer. 2. Breaking of bulk: buying in large quantities from the producer and selling in small lots, usually to the retailer. 3. Taking on risks: if the wholesaler buys goods he bears the risk for it There is always the risk that - the price of a finished product may fall or - the goods won’t be needed because there is no demand. - deterioration: (megromlás) - someone stole it 4. Warehousing: by storing goods the wholesaler saves space for both the producer and the retailer. 5. Offering credit: he may supply goods and allow the retailer to pay at some later date (trade credit). Services provided by the wholesaler For the producer: - reduces transport costs: transport goods from the point of production - finishes goods by grading, packing and branding - make mass production possible by ordering in large quantities and therefore reducing production

cost For the retailer: - offers choice of products from many producers - supplies small quantities to suit retailers needs - quick access to goods and open until late in the evening - advises latest trends and ‘best buys’ - pre-pack goods for the retailers’ shelves (graded, labelled, priced, weighted) Types of wholesaler – three basic forms: 1.) General wholesalers: operate very large warehouses access from many local towns 2.) Cash and carry wholesalers: don’t allow credit and don’t deliver goods Retailers come to warehouses, select goods, pay for them and provide their own transport. 3.) Co-operative Wholesale Society: it supplies its own retail outlets, often obtaining goods from its own factories, farms and plantation. Elimination of wholesaler: Sometimes the producers will by-pass the wholesaler and sell directly to the retailer (in these cases) - if the retailer is part of a large multiple chain, it can buy in large quantities and deal direct with the producer -

where after-sales service is particularly important: durable consumer goods Szaknyelv 7. tétel Agency Agents When you export your goods, you may need the service of some kind of agencies to ensure that the goods reach the final user. Agencies usually work in the country of the buyer Goods should be controlled by agents when: - a knowledge of a distant market is needed - after-sales servicing is needed - you want to introduce goods to a new market Types of agents: 1. Commission agent: He gets orders for goods in name of the exporter He gets a commission for the business what he received. Rates of commission is various, if he has to supply a great deal of information and provide an after-sales services, he gets more money. 2. Del credere agent: The agent takes the credit risk in name of his customer, and he guarantees payment. If so, he gets a higher rate of commission 3. Sole agent: He is appointed for a territory and he gets a commission from all of the business, maked in this

area. The main tasks of commission agents: - control orders - checking the documentation - he is the seller’s representative in the market - he doesn’t carry stock Distributors He is also an agent, but his task is to stock the product and sell it for local buyers. Usually he buys the product from the seller and re-sells it at a higher price, that he makes a profit. Types of distributors: 1. Sole distributor: He ha the exclusive importing rights for a territory He provides after-sales services and sends back information. 2. Distributors who have the goods on consignment: He doesn’t buy the goods, he only receives it from the exporter. The distributor is only responsible for selling them and then accounting to the exporter. Sources of finding an agent: - advertising in trade journals - contacting government departments of trade - consulting Chambers of Commerce, Consulates and banks Parts of the Agency Agreement 1. The names and addresses of both parties 2. The aim of the agreement

3. A description of the goods 4. The territory 5. The duties of the agent 6. Any restrictions 7. The prices and terms 8. Payments for additional work 9. The starting date of the agreement Szaknyelv 8. tétel Transport (air, road, rail and sea) Development of Transport In primitive times animals were used for transportation. Vehicles were pulled by dogs, horses, elephants and camels. They are still an important means of transport in various parts of the world. Water transport started early in cities, London, Paris, Rome which are situated on a river or near to the sea. Road making began at a period when water transport was already highly organized. The first roads in Hungary were also built by the Romans At the end of the 18th century the steam engine was invented. The first public railway in the world, the Stockton and Darlington line opened in England in 1825. At the same time steamships began to operate. In the 20th century steam engines were replaced by electric engines on the

railways and by diesel engines. Nowadays some modern ships use atomic energy. An important development in road transport was the invention of the internal combustion engine. Development of the car and truck industry is very important But for transportation of heavy freight (coal, iron, ore), especially over long distances, railways must still be relied upon. The beginning of the 20th century saw the invention of the airplane At the beginning airlines were used for passenger transport. The first type of air freight was mail, which took up relative little space. Now special aircraft have been designed and are flown on a “cargo only” basis. Rail transport: Today there is a hardly a country in the world, where the railways do not lose money. Rail traffic is fast when actually moving. If goods are to go a long way, rail transport is probably the best. The economic limit is 200 miles Below that limit, road transport is more economic It is economical in the use of labour, because one

driver and two guards can take 60 tons of carriages. Compared with road transport, where lories can take only 32 tons, we can see the advantages of the rail transport. Railway transports has a big problem, and it is the terminal problem. It does not transport for door to door Goods must therefore be loaded and unloaded at terminals to complete their journey by road vehicles. The document used in rail transport is the Consignment Note, which is a receipt for the goods and a contract of carriage. It is made out in several copies. The first copy accompanies the goods It is the duplicate of the Consignment Note. Road Transport: The chief advantages of road transport are: - Terminal handling is eliminated by door-to-door delivery. - Delivery is made direct to the consignee’s premises - Road vehicles are extremely flexible, and computerized route charts can now be prepared which give the most direct or most economic route to be followed. - Specialized vehicles of great variety have been

produced The document used for international road transport is the Consignment Note. Air transport: In modern time an increasing amount of goods is travelling by air. It’s very expensive, but a saving can be made on packing cost, and the insurance premium may be lower. This type of transportation is used when merchandise is urgently required (medicines, fruit, flowers, early vegetables.) or the goods represent a high value (jewellery, furs, watches) Advantages: 1 - the speed of transport - the exporter and the importer are closer to a city with an airport than a seaport Disadvantages: - Its quite expensive - It is unsuitable, of course, for large and bulky goods over, say 30 tonnes in weight. The document used in Air Transport is the Air Waybill. This is a receipt for the goods, and a contract of carriage. Sea transport: Shipping is divided into two main classes: 1. chartered vessels 2. conferences and liner services Chartered vessels are designed mainly to carry such cargoes as

coal, ores, grain, timber etc. The advantage of this shipping is that the ship steamer can be at the port when the cargo is required to be moved. There is a minimum of waste movement Cargo liner companies provide regular traffic between ports in different parts of the world. They are called “conferences” because they hold meetings to agree on routes, timetables, rates. They sail according to a fixed schedule, have fixed routing and the freight rates are quoted according to fixed tariffs. Sailing lists shows the date of sailing, the name of the ship, the closing date, i.e the latest date on which the vessel receives cargo, and the date of arrival at the port of destination. The trade in shipping space is mostly in the hands of shipbrokers. The most important centres of such a trade are exchanges like the Baltic Mercantile and Shipping Exchange in London; moreover there are many other international or local markets at important ports. Pipelines: Pipelines, as a means of transporting

gas, oil or water have assumed a new importance in recent years. The capital costs of installing a pipeline can be considerable, but once laid, the running costs can be low in terms of unit transport cost per kilometre. Forwarding: It is highly important for a foreign trading company to reduce transport costs. The task of minimizing costs of carriage requires special knowledge and training. The agent serving the purpose is called a forwarder. The forwarding agent is bound to enter in his own name and on the principal’s account into contracts of carriage necessary to the transportation of the consignment, while the principal is bound to pay due remuneration therefore. 2 Szaknyelv 10. tétel Incoterms Standardization of Commercial Terms Sending goods from one country to another can be a risky business. If the goods are lost or damaged on the way, disputes may arise between buyer and seller. To avoid such disputes, it is usual to agree, who bears the costs and risks of the

delivery of the goods and up to what point. In the course of the long history of international trade, special commercial terms have been developed. These terms make it possible for the buyer and seller agree on the terms of the sale of the goods without having to define in detail their respective responsibilities in each particular case. The best-known such terms are Incoterms They were first formulated by the International Chamber of Commerce. Incoterms The latest edition of Incoterms contains more than a dozen commercial terms. EXW (Ex Works) The seller places the goods at the disposal of the buyer at the factory. The buyer bears all charges and risks from the time the goods have been placed at his disposal. He pays the price, customs duties taxes, and insurance He pays for the documents that he may need. FOB (Free on board) The seller places the goods on board a ship named in the sales contract. The buyer bears the risk of loss of or damage to the goods from the time the goods have

passed the ship’s rail. The buyer will bear all the expenses and charges of the freight, insurance, etc. CIF (Cost, insurance and freight) The seller delivers the goods to the named port of destination and pays the freight charges. Buyer bears the risk of loss of or damage to the goods from the time the goods have passed the ship’s rail. The seller must also provide all the necessary documents. CFR (Carriage and freight) is essentially the same as CIF, except that it doesn’t include insurance. DCT (carriage paid to the named point of destination) DCT means that the seller pays the freight for the carriage of the goods to the point of destination. The buyer bears the risk from the time the goods have been placed to the first carrier. DCT is used in all kinds of transport, including ferries, containers and trucks. CIP (carriage and insurance paid to) The same as DCT, expect that the seller must pay insurance against the risk of loss of or damage. DES (Ex ship) The seller must make

the goods available to the buyer on board the ship at the destination named in the contract. The seller bears the full cost and risk of bringing the goods there. DAF (Delivered at frontier) The goods are carried by rail or by road. The seller places the goods at the buyer’s disposal at the frontier. The buyer bears all the costs and risks from the time the goods have been placed at his disposal. DDP (Delivered duty paid) Szaknyelv 11. tétel Shipping documents A transport document is a document that indicates the loading on board or dispatching the goods. Its functions are to provide evidence of a contract of carriage, evidence of receipts of the goods, and in some cases they are also documents of title, giving the holder of the documents title of the goods. They are necessary to prove the executing of an order 1. Bill of lading A transport document for goods shipped by sea, in which the ship-owner acknowledges the receipt of the goods and deliver them to their destination under

the terms agreed upon. It has 3 functions: - evidence of a contract of carriage between the shipping company and the buyer to transport the goods by sea - receipt for the goods, and provides some details about the condition of goods received - document of title to the goods, the holder of the B/L has the right to get the goods. Title to the goods can be transferred by the sender by endorsement Types: a) Shipped on Board B/L: acknowledges that the goods have been actually received on board b) Received for Shipment B/L: acknowledges that the goods are in the care of the ship-owner for carriage on a ship, but doesn’t say that the goods on board c) Through B/L, Combined transport B/L: the goods are carried by 2 or more modes of transport 2. Sea waybill or liner waybill A waybill is a list of goods carried. A sea waybill is a transport document which gives details of goods and it acts as contract between the shipping company and the exporter receipt by the shipping company and the

exporter The shipping company will deliver the goods to the consignee named in the bill, without the consignee having to give the shipping company an original copy of the waybill. it is used: if the exporter is sending goods to an overseas subsidiary if the exporter sells goods on open account terms Szaknyelv 12. tétel Means of payment (cheque, bill of exchange) Cheques Cheques are substitute for money and they are easy and safe to use. It is the owner’s direction to a bank to pay a sum of money to a named person or company. Parties to a cheque: - Drawer: he or she draws the cheque - Payee: he or she is the person, to whom the cheque is payable - Drawee: it is the bank, which pays The cheque is only valid if it is dated and signatured by the drawer in the bottom right-hand corner. Different types of cheques: 1. Open cheques (not crossed): The payee could take it to a bank and obtain cash, but anyone else might also be able to cash it. (It concludes the payee’s name)

2. Crossed cheques: they have two parallel lines drawn vertically across them, and are safer than open cheques, because they can only be paid through somebody’s bank account. They can’t be exchanged for cash 3. General crossing: „and company” or „&Co” Is written between the lines The cheque can be paid only to the bank. 4. Special crossing: If the name of the bank is written between the lines the cheque can be paid only to the named bank. A cheque is a negotiable instrument of payment. It can be transferred from person to person before it is actually paid by the bank. The cheque can be transferred by endorsement 1. Blank endorsement on a cheque is an endorsement, which does not state that to whom is that cheque payable it will therefore be paid to the person who presents it. The endorser simply signs his name on the back of the cheque. 2. Special endorsement on a cheque is that only one name of a person to whom or to whose order the cheque is payable. „Pay Beringer

Robert or order” 3. Restrictive endorsement on a cheque is one name, which forbids further negotiation of the cheque. „Pay Beringer Robert only” Bills of exchange A bill of exchange is an unconditional order in writing, addressed by one person (drawer) to another (drawee) signed by the person giving, requiring the person to whom it is addressed to pay on demand or at a future fixed time a sum of money to a specified person. Bills of exchange can be transferred by endorsement. The person who transfers them is the endorser, the other one to whom it is transferred is the endorsee. Any endorser is fully liable for the bill and must pay it if the acceptor fails to pay. If an endorser does not want to be hold responsible for the bill, he writes a signature: „without recourse to me”. Bill of exchange must be presented for payment during business hours on the day they are due. If the date of maturity falls on Sunday or any other holiday, the bill is due on the last working day. If it

falls on a bank holiday, the bill is due on the next working day. If the drawee refuses the bill or to pay on maturity, the bill is said to be dishonoured and must be protested. The bill payable at a future time might sold to a bank or a discounting house, which pays the sum of the bills less interest and discounting charges. Szaknyelv 13. tétel Methods of payment (letter of credit, documentary collection) D O C U M E N T A R Y C O L L E C T I O N (D/P O R D/A) It is an operation in which a bank collects payment on behalf of the seller by delivering documents to the buyer. It is only used if there is a relationship of trust between the buyer and the seller. A D/P is a suitable method of payment if The buyer’s ability and readiness to pay are all right The political and economic conditions in the importing country are stable. The importing country places no restrictions on imports 1. 2. 3. 4. exporter, seller remitting bank presenting bank (collecting bank) importer,

buyer The four parties to the operation: How does a D/P work? 1. The exporter stipulates the terms of payment with the buyer in the contract of sale 2. After the signing of the contract of sale, the seller dispatches the goods direct to the address of the buyer. He sends all the necessary documents to his own bank (the remitting bank) together with the collection order. The remitting bank then remits the documents, together with the necessary instruction, to the collecting bank. 3. The presenting bank informs the buyer of the arrival of the documents The buyer makes payment, or accepts the bill of exchange, and in return receives the documents. The presenting bank then transfers the collected amount to the remitting bank, which credits it to the principal’s account. THE DOCUMENTARY LETTER OF CREDIT It is a reliable and safe method of payment, and it protects the seller as well as the buyer. It is an undertaking given by a bank at the request of a buyer to pay a particular

amount in an agreed currency to a seller How does a L/C work? 1. The buyer (importer) asks his bank to issue or open a L/C in favour of the seller There is usually a special application form, which the buyer fills in and sends to his bank. 2. The buyer’s bank will then select a bank in the exporter’s country and notify them that the credit has been opened. 3. The seller’s bank will notify the exporter that a credit has been opened 4. The seller (exporter) ships the goods before the credit expires and sends the shipping documents to his bank that checks the documents against the conditions and pays him. 5. The seller’s bank will then send the documents and debit the buyer’s bank with the cost and charges. 6. The buyer’s bank then checks the documents, pays the seller’s bank and sends the documents to the buyer so that he can claim the goods. Szaknyelv 14. tétel Banks Historical background The Hungarian banking system is linked historically to the Austrian banking

system. Austrian commercial banks together with the central bank traditionally carried out their activities in Hungary. After 1945a process began to nationalise the banking system. The law stated the ownership of the NBH and the main commercial banks. The primary functions of the NBH were developed in 1948, and a one-tier banking system has been established. In this model the central bank provides commercial bank functions, grants credits, and accepts deposits. The two-tier banking system On January 1, 1987 changes were introduced in Hungary’s banking system. The central and commercial banking functions were separated. The new two-tier banking system is, where the central bank is the bank of the banks, and the commercial banks are in direct contact with companies and public. The new system allows the NBH to focus on macroeconomic policy issues, leaving the microeconomic aspects to the commercial banks. The main functions of the central bank are the followings: - it issues bank notes

and coins - it makes proposals for money and credit policy - determines the rules of money circulation - it collects reserves of gold and foreign exchange and manages them - it determines and publishes the official exchange rate of foreign currencies - it coordinates the relation of Hungary with the international financial institutions The NBH has complete independence in the formulation of its policy, but it must determine the exchange rate policy with the government. When the two-tier banking system was started in January 1987 the commercial banking functions (keeping accounts, active and passive banking operations etc.) were taken over by three new big commercial banks - Hungarian Credit Bank Ltd. (MHB) - Commercial and Credit Bank Ltd. (KHB) - Budapest Bank Ltd - Hungarian Foreign Trade Bank Ltd. Banking services to the population (to the public) were provided by the National Savings Bank (OTP), and Postabank. At the start of the two tier banking system, 15 non-monetary financial

institutions functioned in Hungary Szaknyelv 15. tétel Complaints and ajustments Complaints Non-fulfilment of the contract may be caused by the seller ot the buyer, or by so called „Act of God”. When the buyer or the seller is at fault, a letter of complaint is sent to him If the seller is at fault, the most usual cases are: 1. Defect in quality - bad quality - differencies from the goods, what we have ordered In these cases the buyer may: - refuses to accept the goods - accept the with an extra discount 2. Defect in quantity - oversuply: the seller has delivered more goods than we have ordered - shortshipment: not enough goods have been delivered. In this case the buyer may: - refuse to accept them - accept the as partial delivery - pay for what have been delivered and cancel the rest of the order. 3. Delay It happens when the seller fails to deliver in time. In this case the buyer can extend delivery time. If even the seller doesn’t deliver, the buyer may: - extend the

delivery time once more - buy the goods at the seller’s cost - cancel the order 4. Unsuitable or faulty packing It can cause damage to the goods, and the insurance companies will not accept responsibility about it. In this cases: - the buyer may accept damaged goods if the supplier offers a discount - if the goods are badly dsamaged, the buyer can ask for replacement 5. damages This is usually a matter for the insurance agent 6. Other defects Sometimes documents are not in order, there is a mistake in the invoice. The buyer is at fault, when: - he refuses to accpet the goods without sufficient grounds - he may cause difficulties by omitting to give transport intructions in time - he refuses to pay, thougy ha has already accpeted the goods. In such case it is necessary to send a remainder A letter of complaint should be written in a firm but quiet, and objective tone. Adjustments Before a complaint is admitted, it is necessary to decide whether it is justified. If the costumer’s

complaint is well founded, the claim must be granted promptly, and the seller must to eliminate similar errors in the future. When the customer’s complaint is not justified, the claim is refused, but the seller must carefully explain why he refuses it. It may also happen, that a third party, e.g the carrier is at fault In such cases the seller does his best to make good the fault and to help his customer. A complaint should be answered promptly, if the explanation cannot be sent immediatly he must inform the customer of the result as soosn as possible. Szaknyelv 16. tétel Advertising, sales promotion, trade fairs and exhibition Marketing an Advertising The most important function of marketing is to buy at as low a price as possible and sell at a price high enough to ensure a good profit. In order to achieve that, research is carried out to provide information on the size of the market and the price for which product or service can be sold or bought. Marketing is concerned with

packaging, promoting and distributing the product and also deals with after-sales service. The aim of advertising is to inform the public of the advantages of a product or service (what can be obtained, and where, for how much, etc.) Advertising dates back to ancient times In the Middle Ages street vendors cried the names of the goods they wanted to sell. In the 12th century in France the criers went through the streets giving samples of their drink. Printed advertising came later. Outdoor advertising became popular in England Posters appeared on every wall. Today, the most important advertising media are: newspapers, magazines, radio and television commercials, outdoor advertising and direct mail advertising. It is important for a company to maintain good public relations. By public relations we mean the relations between a company and the general public. These relations must be kept friendly in various ways. Public relations are big business today One important aspect of

communication is advertising. It is the means by which we make known what we have to sell or buy. Without advertising a mass-production system could not function. There are two kinds of advertising, informative and persuasive advertising The latter does not just inform, it uses subtle techniques to persuade and delude the public into buying. Selling goods can rarely be done by the product itself or by price alone Continuous publicity is needed to support the sales efforts and to make known the full range of products. A successful sales campaign depends upon four main fundamentals They are: a good product at a competitive price a sound market policy reliable representatives close personal attention to the market Whether it is consumer or capital goods that are subject of the campaign the main ways in which it can be executed are: paid advertising editorial publicity literature describing the products display materials trade fairs and exhibitions A distinction is made between trade fairs

and exhibitions. Trade fairs are markets, and usually feature the products of one or more industries. They may be visited only by business people. Sales are made on the basis of samples No goods are sold directly at stands. Exhibitions, on the other hand, are meant also for the general public 1 Szaknyelv 17. tétel Types of business companies There are two main enterprises: Private and Public Enterprise Private Enterprise: Business that are owned by private individuals, engaged in the production of goods or services. There are 4 main types of private enterprise: - Sole traders - Partnership - Private limited companies (Ltd) - Public limited companies (Plc) Sole traders This type of company is owned by one person, who provides all of the capital needed to form, or expand the business. This is the simplest and most common type of enterprise Advantages: needs relatively small amount of money, no consulting with partners, no sharing of profits Disadvantages: the business has

unlimited liability, difficulty in continuing business in case of absence, difficult to borrow money. Partnership Two to twenty memebers are in the business and work together for profit. At least one partner must accept unlimited liability. A sleeping partner is one who invests in the business but takes no active part in running it. Advantages: easily formed, greater continuity than sole trader, expenses and management are shared Disadvantages: generally unlimited liability, possible conflicts between partners. Private limited company (Ltd) It is allowed from two to an unlimited number of members (shareholders). The capital of the company is divided into shares, but the shares are not sold on the Stock Exchange and they cannot be advertised for sale publicity. Advantages: more people can provide it with capital, ha greater continuity, has limited liability. Disadvantages: shares cannot be offered for public sale. Public limited company (Plc) It is allowed from two to an unlimited

number of shareholders, and it can advertise shares for public sale. Its shares are listed on the Stock Exchange When an investor buys shares in a company, he becomes a part owner and gets the right to say in the way that company is operated. Advantages: limited liability, maximum continuity, ability to raise large sums of capital, easier to borrow money. Disadvantages: too many rules Special business relationships Franchising: In franchising a company allows someone to buy the right to use their products or techniques under their trade names. It offers a ready-made business opportunity for those who gave the capital and wants to work hard. It also provides a strong marketing background Holding companies: Businesses from a temporary combination to achieve a certain aim, e.g in order to bring together several processes, into one production unit. Each member company retains its legal entity